Identify hidden overpayments, duplicate invoices, and supplier errors with precision. Our AP audits recover lost revenue while strengthening processes.

At Audit Partnership, we help leading global businesses reclaim hidden funds from their supplier spend through specialist Accounts Payable (AP) recovery audits. Our state-of-the-art technology uncovers duplicate payments, missed credits, and other financial leakages that often go undetected in busy finance environments.

With decades of experience, we’ve recovered millions of funds for organisations like yours, improving cash flow, strengthening supplier relationships, and ensuring your accounts payable process works at its best.

Get in touch today for a consultation and discover how much value we can recover from your existing AP data.

At Audit Partnership, we apply a structured, data-led methodology that not only recovers lost funds but also improves your financial control. Here’s how we ensure you gain full visibility, accountability, and measurable value from every audit.

Our approach is built to minimise disruption and maximise recovery. We combine expert auditors, proven processes, and advanced analytics to provide a seamless experience for your internal teams.

Discover how leading organisations recovered millions and strengthened AP processes through our customised recovery audits and advanced solutions.

We conduct a thorough and independent review of your financial transactions and supplier agreements.

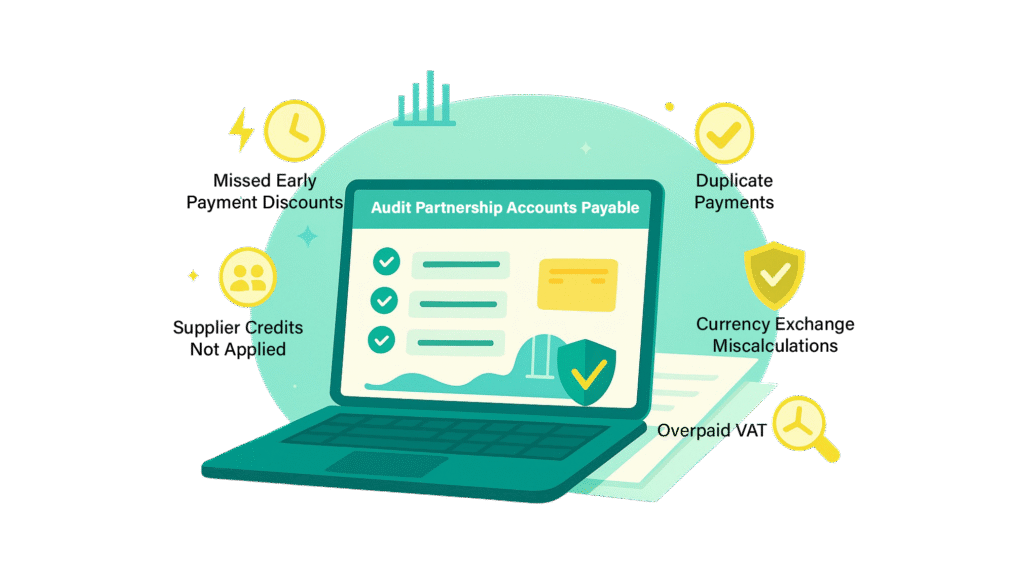

Our audits typically uncover recoverable funds from areas such as:

At Audit Partnership, our people are at the heart of every success. Through our employee stories, discover how we support growth, nurture talent, and empower individuals to make a real impact, professionally and personally, while building rewarding careers in a genuinely collaborative, global environment.

“Their attention to detail and creative design approach transformed our website into a visually stunning and highly functional platform. We’ve seen a 30% increase in traffic since the relaunch. I highly recommend them to anyone seeking professional web design services!”

“Their attention to detail and creative design approach transformed our website into a visually stunning and highly functional platform. We’ve seen a 30% increase in traffic since the relaunch. I highly recommend them to anyone seeking professional web design services!”

Efficient accounts payable (AP) management is crucial for any business, as it impacts cash flow, vendor relationships, and overall financial health. This blog provides 10 practical tips to optimise your

Audit Partnership’s Accounts Payable Recovery Audit helps you turn financial leakage into financial opportunity. Whether you are looking to improve your working capital, implementing a new ERP or process or simply want assurance your processes are air tight, our team is ready to help.

An Accounts Payable audit is a detailed review of supplier payments and transactions to identify overpayments, duplicate invoices, missed credits, and other financial errors. At Audit Partnership, our AP audits help recover lost revenue and strengthen your financial controls.

Our process is simple and non-disruptive. We securely collect your data, use advanced analytics to identify potential recoveries, validate findings, recover lost funds, and deliver a detailed final report with actionable insights.

Our audits typically identify duplicate payments, missed supplier credits, overpaid or unclaimed VAT, unclaimed discounts, and currency exchange miscalculations, helping you reclaim hidden funds from your supplier spend.

Data protection is our top priority. We’re certified under ISO 27001 and ISO 9001, ensuring your sensitive financial data is handled with the highest standards of security and quality management.

You’ll receive a comprehensive report detailing recovered funds and process insights. Beyond recovery, we provide recommendations to prevent future errors and continuously enhance your AP efficiency.