The field of recovery audit is constantly evolving to keep up with changes in business environments and regulations. Understanding emerging future trends in recovery audits is crucial for organisations to enhance their audit processes and outcomes. This blog discusses the top five trends that are likely to shape the future of recovery auditing over the next few years.

The recovery audit industry has come a long way since its inception in the 1980s. What started as a manual process of examining paper invoices and payments has evolved into a sophisticated data-driven operation leveraging advanced technologies like artificial intelligence and machine learning.

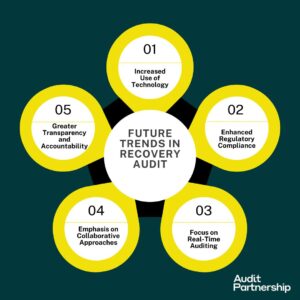

As we look ahead to the next decade, several key future trends in recovery audit are emerging that will continue transforming the way organisations identify overpayments. Here are our top five predictions for where the field of recovery audit is headed. But before that, let’s understand the importance of staying ahead of trends.

Importance of Staying Ahead of Trends

The recovery audit industry is constantly adapting to changes in technology, regulations, and stakeholder needs. Failing to recognise key future trends in recovery audits can render audit programmes outdated and ineffective. It is therefore important for auditors to closely track emerging patterns and proactively implement necessary changes.

Staying ahead of the curve allows for smooth transitions and helps deliver optimal value. With a solid understanding of likely trends, organisations can future-proof their audit strategies for continued success.

Trend 1: Increased Use of Technology

One of the biggest future trends in recovery audits is the enhanced use of technologies like automation, artificial intelligence, data analytics, and predictive modelling. These tools are poised to revolutionise audit recovery processes.

Automation and AI in Recovery Audits

Advanced automation and artificial intelligence will allow for more efficient handling of larger volumes of data and claims. Tasks like identifying common billing errors, duplicates, and outliers can be automated. AI algorithms can also detect complex fraud patterns that humans may miss. This will free up auditors to focus on complex experience-based reviews.

Data Analytics and Predictive Modelling

Leveraging past claims data, auditors can build predictive models to identify high-risk areas and providers for targeted auditing. Data analytics gives insights into root causes of errors. Real-time dashboards powered by analytics will facilitate continuous monitoring of key metrics.

Trend 2: Enhanced Regulatory Compliance

Regulatory changes bring both opportunities and challenges. Staying compliant amid evolving rules is crucial for recovery audit programs.

Changes in Legislation Impacting Recovery Audits

International regulations like GDPR impact data security protocols, as well as the Grocery Supply Code of Practice (GSCOP) for the UK . Auditors must keep abreast of regulatory developments that affect recovery audit data security and audit practices.

Best Practices for Compliance

Following industry best practices can help ensure seamless compliance. Regular reviews and updates to compliance programmes will keep audit methodologies on the right side of regulations.

Trend 3: Focus on Real-Time Auditing

The traditional periodic audit approach is transitioning to continuous, real-time auditing enabled by new technologies.

Shift from Periodic to Real-Time Auditing

With tools like predictive analytics and automated monitoring, audits can occur on an ongoing accelerated real-time basis rather than historic cycles. Issues are identified and prevented much faster through real-time auditing.

Benefits of Real-Time Monitoring

Real-time dashboards provide up-to-date insights. Errors caught early can be resolved quickly, avoiding large recoupments. Real-time auditing also improves collaboration between auditors and suppliers.

Trend 4: Emphasis on Collaborative Approaches

Future recovery audits will see greater emphasis on collaboration between auditors and client organisations.

Partnerships Between Auditors and Clients

Collaborative partnerships help create audit programmes designed to meet your objectives and develop a road map for success. This leads to improved processes and reduced future errors.

Cross-functional Collaboration for Better Outcomes

Auditors will work closely with clients billing departments and trading teams. Joint training programmes and knowledge-sharing sessions can yield highly beneficial outcomes.

Trend 5: Greater Transparency and Accountability

Stakeholders are increasingly demanding transparency around audit methodologies and outcomes.

Increasing Demand for Transparency in Audits

Publishing audit protocols and reports promotes accountability. It also helps address concerns around targeted auditing.

Building Trust with Stakeholders

Transparency builds credibility and trust with stakeholders. It positions recovery audits as collaborative improvement tools rather than “debt collectors.”

Get The Best Audit Services From The Audit Partnership

Audit Partnership is a top provider of recovery audit services. We have excellent experience performing recovery audits across different sectors. Our specialised teams carefully examine agreements and invoices to find overpayments.

We work closely with clients to develop optimal processes, identify compliance issues, enhance systems, and maximise recoveries. Working with us ensures a full-service recovery audit implemented according to worldwide standards.

Conclusion

The future of recovery audits holds promising trends centred around technology, compliance, collaboration and transparency. By proactively responding to these changes, organisations can future-proof their audit programmes and deliver optimal value.

The industry’s focus will increasingly shift from post-payment error identification to real-time prevention through continuous auditing and process improvements. Recovery auditing is poised for significant transformation, leveraging emerging technologies.

The next few years will witness rapid evolution as new technologies and collaborative approaches become mainstream. Recovery auditing is all set to transform into a real-time, compliance and improvement tool.

Frequently Asked Questions (FAQs) – Future Trends in Recovery Audit

1. How will regulations around data privacy/security impact recovery audits?

Regulations like GDPR will require strict protocols around collection, storage and sharing of protected health information. Auditors must ensure compliance.

2. What skills will auditors need to succeed in the future?

Technical skills like data analytics, programming and AI/automation will be crucial alongside domain expertise. Collaboration and relationship management also gain importance.

3. How can auditors gain provider trust amid evolving trends?

Transparency, education initiatives and positioning audits as improvement partners rather than “debt collectors” can help gain the trust of providers.