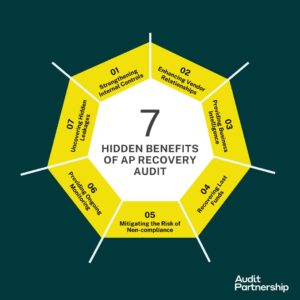

AP recovery audit can help companies uncover hidden savings and ensure payment accuracy. While direct financial recovery is an obvious benefit, there are also lesser-known advantages. In this blog, we will explore the hidden benefits of AP recovery audit program.

Overview of Accounts Payable Recovery Audit

An accounts payable recovery audit is a process where an independent third party examines a company’s paid invoices and transactions to identify supplier overpayments. The auditor will search for items like duplicate payments, invoice errors, rebates, and other discrepancies that resulted in the business overpaying vendors. By thoroughly reviewing past payments, recovery auditors can find money owed to the company.

An accounts payable recovery audit involves a third-party vendor thoroughly examining a company’s paid invoices and transactions from a defined period, usually the past one to three years.

The auditor will analyse invoices, purchase orders, receipts and other documentation to identify potential overpayments or billing inaccuracies. Some common types of overpayments auditors search for include:

- Duplicate payments – when the same invoice was paid more than once

- Pricing errors – discrepancies between what was ordered and billed

- Rebates/chargebacks – amounts owed back to the company but never claimed

- Freight charges – unauthorised or inflated shipping costs passed on

- Credits/refunds – money owed for returned items never received

- Tax errors – incorrect sales tax or other tax calculations

What are the Hidden Benefits of AP Recovery Audit?

While the direct recovery of overpaid amounts is an obvious advantage, there are also some lesser-known benefits to consider:

1. Strengthening Internal Controls

The primary goal of an AP recovery audit is to identify and recover overpayments, but it also strengthens a company’s internal controls. By thoroughly reviewing invoices and payments, an external auditor can help identify weaknesses, gaps, or areas of non-compliance within the AP process.

They may find instances where the same invoice was paid twice, payments were made without proper approvals, or invoices were paid for non-contracted services. By catching these types of issues, an AP recovery audit helps improve internal controls to prevent future errors or fraud from occurring.

It ensures policies and procedures are followed consistently. With stronger internal controls in place, a company faces less risk of making improper payments going forward.

2. Enhancing Vendor Relationships

While an AP recovery audit may identify overpayments to vendors, it need not damage vendor relationships when handled properly. When an overpayment is found, the auditor works directly with the vendor to resolve the issue, often negotiating a repayment plan.

This keeps the process collaborative rather than confrontational. It also gives vendors transparency into a company’s audit practices. As a result, AP recovery audits can help enhance supplier relationships. Vendors see the company as having responsible financial practices and being fair in addressing overpayments. They respect the company’s commitment to accuracy in invoicing and payments.

3. Providing Business Intelligence

An often overlooked benefit of AP recovery audit is the wealth of business intelligence that can be uncovered. By analysing invoices, payments, and procurement patterns in depth, auditors gain insights into a company’s spending behaviours.

They may find opportunities to renegotiate contracts, consolidate suppliers, identify maverick spending, or surface areas where processes could be streamlined. All this intelligence gathered from the audit can be reported to the company and used for strategic sourcing and process improvement initiatives.

The audit becomes a way to optimise procurement beyond recovering overpayments. It reveals ways to reduce costs through better-negotiated rates, eliminate non-value-added steps, and gain efficiencies. Business intelligence is one of the most valuable yet hidden benefits of an AP recovery audit.

4. Recovering Lost Funds

Of course, the most direct and obvious benefit of an AP recovery audit is recovering cash that was mistakenly paid out. On average, AP recovery audits identify 0.01-0.15% of total payables spent as overpayments that can be recovered. However, for large companies with billions in annual procurement spending, even 0.1% equates to millions of dollars left on the table each year without an audit in place.

Recovering these lost funds has an immediate positive impact to a company’s bottom line. It’s money that can be put back into the business, used to fund other strategic initiatives, or returned to shareholders. The financial recovery aspect alone often justifies the relatively low cost of an AP recovery audit for most organisations.

5. Mitigating the Risk of Non-compliance

Another hidden benefit of an AP recovery audit is risk mitigation. Thorough auditing of invoices and payments helps ensure all compliance requirements are being met. Auditors are trained to spot instances where applicable sales tax/VAT was not charged, invoices do not meet spending policy thresholds, or services were procured from non-preferred suppliers in violation of agreements.

By catching compliance gaps or non-compliance issues, the company faces less regulatory and legal risk down the road. It demonstrates responsible stewardship of funds and adherence to procurement policies. This risk mitigation should be considered another valuable benefit of an AP recovery audit, even if a cash amount cannot be directly assigned to it.

6. Providing Ongoing Monitoring

Most AP recovery audits are conducted on an ongoing, continuous basis rather than as a one-time event. This allows the auditors to monitor payment activities and catch errors or overpayments in real time rather than having to wait and review historical data. It establishes an ongoing check of the AP process rather than a single retrospective look.

Catching issues sooner enables faster recovery of funds. It also ensures the benefits of AP recovery audit like strengthened controls and recovered savings, can be sustained over the long run. Ongoing auditing acts as a permanent safeguard for the procurement function.

7. Uncovering Hidden Leakages

Many companies are unaware of how much may be leaking out unintentionally through their AP processes each year due to minor errors or inconsistencies that accumulate. These include things like improper sales tax calculations, duplicate invoice payments, unprocessed credits, invoice date mismatches, and other small issues.

While individually trivial, these hidden leakages can equate to substantial unrecovered funds when added together. Because AP recovery audits entail meticulous invoice-level examination, they are uniquely equipped to uncover these types of hidden errors. Auditors are able to ferret out small problems companies may miss with their internal reviews alone. Getting good at capturing every penny, no matter how small, is a benefit of AP recovery audit that should not be overlooked. Also “Capture” is the Digital Lab software by Audit Partnership to make these things easier for your businesses.

These are some of the hidden benefits of AP recovery audit programs that companies may not initially consider but can provide great long-term value to the accounts payable function and the overall business.

Get The Best Recovery Audit Services From Audit Partnership

For companies looking to realise both the visible and hidden advantages of an accounts payable recovery audit, partnering with an experienced provider like Audit Partnership is recommended. As the leader in recovery audit services, Audit Partnership has recovered billions of dollars for clients across industries.

By partnering with an industry leader like Audit Partnership, companies can be confident their recovery audit will identify all opportunities for savings while also strengthening payment controls for long-term benefits.

Conclusion

While the direct recovery of overpayments is an obvious advantage, The hidden benefits of AP Recovery Audit that companies should consider. A recovery audit enhances payment accuracy, promotes contract compliance, drives process improvements, builds stronger supplier relationships, and offers valuable financial insights.

Companies can maximise returns with the right partner to conduct the audit while gaining ongoing efficiencies. Overall, a recovery audit delivers both visible and unseen value, making it a smart investment for any organisation looking to optimise its accounts payable function. Contact Audit Partnership for collaborating for any AP Recovery Audit.

FAQs Related to Hidden Benefits of AP Recovery Audit

1. What is an accounts payable recovery audit?

An accounts payable recovery audit involves an independent third party thoroughly examining a company’s paid invoices and transactions from the past years to identify potential overpayments to suppliers. The goal is to find errors or discrepancies that resulted in the company overpaying vendors.

2. How does a recovery audit identify overpayments?

A recovery audit analyses invoices, purchase orders, receipts, and other documentation to find potential overpayments, such as duplicate payments, pricing errors, unclaimed rebates/chargebacks, inflated freight charges, unreceived credits/refunds, tax errors, etc.

3. What are the indirect benefits of an AP recovery audit?

It strengthens internal controls, enhances vendor relationships, provides business intelligence, mitigates compliance risks, offers ongoing monitoring, and uncovers hidden errors/leakages that are costing companies.

4. How does it strengthen internal controls?

By thoroughly reviewing payments, auditors find weaknesses or non-compliance in processes. This helps improve policies to prevent future errors/fraud.

5. How does it enhance vendor relationships?

Issues are resolved collaboratively rather than confrontationally. Vendors see the company has responsible practices and fairness in addressing overpayments.