Recovery audits are a process where an independent third party examines billing and payment records to identify erroneous transactions and overpayments. Recovery audits enhance operational efficiency by identifying errors, reducing leakage, and improving processes.

Significance of Recovery Audit in Operational Efficiency

Recovery audits are important for any organisation looking to enhance operational efficiency. By identifying billing errors and recouping overpayments, recovery audits help optimise cash flow. They provide valuable insights into processes, helping pinpoint areas that need improvement.

Recovery audits enhance operational efficiency by uncovering opportunities to streamline workflows, eliminate inefficiencies, and ensure compliance with payment policies. Regular recovery audits help maintain operational excellence over the long run.

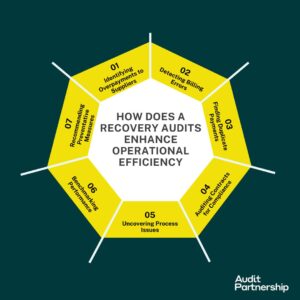

How does a Recovery Audit Enhance Operational Efficiency?

Some key ways that recovery audits enhance operational efficiency include:

1. Identifying Overpayments to Suppliers

Mistakes happen when processing large volumes of invoices, and overpayments slip through the cracks. Recovery audits catch these errors, allowing organisations to recoup funds that were paid out incorrectly. Getting overpayments back into the budget enhances cash flow and operational efficiency.

2. Detecting Billing Errors

Suppliers sometimes charge incorrectly due to mistakes in contracts, rates, or item counts. Recovery audits compare bills to source documents to flag any discrepancies. Correcting billing errors prevents wasteful ongoing overspending that saps operational efficiency.

3. Finding Duplicate Payments

With complex payment systems, it’s easy for the same invoice to be paid twice accidentally. Recovery audits cross reference payments to catch duplicates, again improving cash flow. Eliminating duplicate spending enhances operational efficiency.

4. Auditing Contracts for Compliance

Recovery audits examine vendor contracts for compliance with agreed upon terms. Any deviations that result in overspending are identified. Ensuring contract compliance enhances operational efficiency by containing costs within agreed budgets and ensuring terms and conditions are met.

5. Uncovering Process Issues

The root causes of errors uncovered by recovery audits are analysed. Process weaknesses are often identified that allow mistakes to repeatedly occur. Fixing these systemic issues enhances overall operational efficiency long-term.

6. Benchmarking Performance

Recovery audit results provide metrics on error rates within spending categories. This allows organisations to benchmark performance against industry standards and peers. Identifying areas with high error rates focusses efforts to enhance processes where it is needed most to boost operational efficiency.

7. Recommending Preventative Measures

In addition to recovering funds, quality recovery audit providers also recommend internal controls and procedures to prevent future errors. Implementing these preventative measures enhances operational efficiency on an ongoing basis.

Benefits of Recovery Audits in Enhancing Operational Efficiency

The tangible benefits of regular recovery audits in enhancing operational efficiency include:

- Increased cash recovery: On average, recovery audits find over a million for every billion audited. Identifying and correcting these errors can significantly boost recoveries and optimise cash flow.

- Improved accuracy: Post audit, organisations typically see a 15-30% reduction in future claim payment errors. Higher accuracy means less rework and fewer disputes—directly enhancing workflow efficiency.

- Data-driven process improvements: insights from audits are used to streamline workflows, coordinate functions better, automate manual tasks and implement controls. All of which enhance process efficiency in the long run.

- Regulatory compliance: Audits ensure compliance with laws and policies. Non-compliance leads to disputes, penalties and inefficient resolutions. Compliance enhances consistent operations.

- Benchmark performance: Understanding performance gaps drives goal setting and initiatives for continuous efficiency enhancements over time through benchmarking.

Get the Best Recovery Audit Services from Audit Partnership

Audit Partnership is a leading provider of recovery audit services helping organisations enhance operational efficiency. Our experienced team can identify a wide range of billing errors to maximise recoveries. Advanced analytics tools and process expertise help drive ongoing efficiency improvements.

Clients benefit from increased cash recovery, reduced costs, improved accuracy and streamlined operations through recovery audits. Contact Audit Partnership today to discuss how their recovery audit services can enhance your organisational efficiency.

Conclusion

Taking time to thoroughly audit past spending through a recovery audit process enhances operational efficiency in many ways. From recovering lost funds to fixing systemic issues, recovery audits deliver both immediate and ongoing benefits. Their dual focus on recovery and prevention maximises returns.

For any organisation seeking to tighten processes, eliminate waste, and optimise performance, making recovery auditing a regular discipline should be a high priority. Consistently leveraging this strategy enhances operational efficiency to drive long-term success.

Frequently Asked Questions (FAQs) – Recovery Audit Enhance Operational Efficiency

1. What is a recovery audit?

A recovery audit is a process where an independent third party examines billing and payment records to identify overpayments made to suppliers. The goal is to recover funds that were paid out incorrectly and provide insights to improve processes.

2. How can recovery audits enhance operational efficiency?

Recovery audits can enhance efficiency by identifying billing errors, catching duplicate payments, ensuring contract compliance, uncovering process issues, benchmarking performance, and recommending preventative measures. This helps optimise cash flow, reduce costs, improve accuracy and streamline operations.

3. What are some common types of errors identified in recovery audits?

Common errors include overpayments due to billing mistakes, duplicate payments, non-compliance with contract terms and conditions, failure to apply discounts/credits, and incorrect billing of tax charges.

4. How much cash can be recovered on average from a recovery audit?

On average, recovery audits find over a million for every billion audited. Identifying and correcting these errors can significantly boost recoveries and optimise cash flow.

5. How can recovery audits help reduce future payment errors?

By identifying root causes, recovery audits help organisations streamline workflows, automate manual tasks, and implement controls. This can lower future claim payment errors by 15-30% on average.